In a significant case highlighting cryptocurrency fraud‘s dangers, an Australian national and a California man have been charged with running a Ponzi scheme that defrauded victims out of more than $25 million. The indictment reveals a complex and deceitful operation, shedding light on how such scams can devastate individuals’ finances and trust.

The Scheme Unveiled

According to court documents, David Gilbert Saffron, 51, of Australia, and Vincent Anthony Mazzotta Jr., 52, of Los Angeles, orchestrated a fraudulent scheme that promised high-yield profits through various cryptocurrency trading programs. These programs, including Circle Society, Bitcoin Wealth Management, Omicron Trust, Mind Capital, and Cloud9Capital, falsely claimed to use an artificial intelligence automated trading bot to trade victims‘ investments in cryptocurrency markets.

Instead of investing the funds as promised, Saffron and Mazzotta allegedly misappropriated the money for personal luxuries such as private jet flights, luxury hotel stays, mansion rentals, and personal chefs and security. The indictment further alleges that they created a fictitious entity called the Federal Crypto Reserve to trick victims into paying more money under the pretense of investigating and recovering their losses.

The Deceptive Tactics

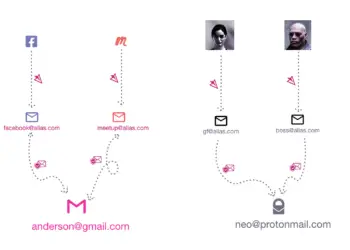

To execute their scheme, Saffron and Mazzotta employed various aliases and online personas, including “David Gilbert,” “Dave Gabe,” “the Blue Wizard,“ and “Bitcoin Yoda.“ These personas were used to gain the trust of their victims and obscure their true identities.

Furthermore, they allegedly conspired to obstruct justice by hiding assets, destroying evidence, and falsifying records. Techniques such as “blockchain hopping“ and using services known as “mixers“ or “tumblers“ were employed to conceal the source and location of the stolen cryptocurrency, making it difficult for authorities to trace the funds.

Legal Consequences

Saffron and Mazzotta face multiple charges, including conspiracy to commit wire fraud, conspiracy to obstruct justice, conspiracy to commit money laundering, and conspiracy to commit money laundering. If convicted, each faces a maximum penalty of 20 years in prison for each conspiracy to commit wire fraud and money laundering, 20 years for each wire fraud count, ten years for each money laundering count, and five years for conspiracy to obstruct justice. Additionally, Saffron could face up to 10 years for committing felonies while on pre-trial release.

Official Response

Acting Assistant Attorney General Nicole M. Argentieri of the Justice Department’s Criminal Division, U.S. Attorney Martin Estrada for the Central District of California, and Special Agent in Charge Tyler Hatcher of the IRS Criminal Investigation (IRS) Los Angeles Field Office announced the indictment. IRS is investigating the case, with prosecution handled by Trial Attorneys Theodore Kneller and Siji Moore of the Criminal Division’s Fraud Section and Assistant U.S. Attorney James Hughes for the Central District of California.

The Commodity Futures Trading Commission (CFTC) had previously charged Saffron by complaint, indicating the severity and breadth of the fraudulent activities.

Protecting Yourself from Investment Scams

This case is a stark reminder of the importance of vigilance in financial matters, especially with high-risk investments like cryptocurrency. Here are some tips to protect yourself:

- Research Thoroughly: Before investing, research the company, its officers, and the investment opportunity. Look for reviews and any regulatory warnings.

- Verify Claims: Be wary of promises of high returns with little or no risk. If it sounds too good to be true, it probably is.

- Check Credentials: Ensure that financial advisors or investment managers are appropriately licensed and registered with appropriate regulatory bodies.

- Secure Communication: Avoid sharing personal or financial information through unsecured communication channels.

- Stay Informed: Keep up-to-date with the latest financial fraud and scam news.

If you believe you are a victim of this or any other investment scam, contact the Fraud Section’s Victim Witness Unit toll-free at (888) 549-3945 or by email at [email protected]. More information on victims‘ rights can be found at Justice Department Victim Rights.

By staying informed and cautious, you can protect yourself from becoming a victim of fraudulent schemes and safeguard your financial future.

We at SecureCyberNetwork are dedicated to providing you with the latest updates, tips, and expert advice to keep you safe in the digital world.

Your commitment to staying informed is about your safety, the safety of your loved ones, and the safety of our community.

Your involvement is powerful.