Law enforcement has observed a significant increase in targeted phishing, smishing, and vishing scams to compromise EBT card data.

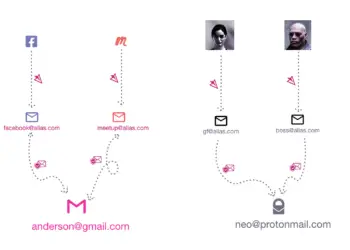

- Phishing involves emails designed to obtain victims’ personally identifiable information or financial credentials. Scammers typically pose as a creditor, bank, or state benefits agency.

- Smishing: SMS text messages are used instead of email.

- Vishing: Uses phone calls, generally with an automated voice.

These EBT-related calls or messages seek to trick cardholders into entering their card details without thinking by creating a sense of distress. Scammers often reference the closing of the EBT account or a loss of funds to achieve this.

Tips to Avoid EBT Phishing or Related Scams

If you receive a call, text, or email asking for card information, you should separately:

- Contact the relevant state benefits agency to verify the authenticity of the message(s) and

- Verify the status of the EBT account and current funds using a known balance inquiry line, website, or the relevant mobile application.

If you receive a call, text message, or email asking for your PIN, keep it private. State benefits agencies won’t request cardholder PINs. They’ll use other means to authenticate your account.

Always use a strong PIN. Avoid using PINs that may be easily guessed, such as strings of the same or consecutive numbers.

If you suspect your EBT card was compromised in this type of scam:

- Immediately contact your state benefits agency or card issuer.

- Promptly change your PIN if any funds remain in your EBT account.

- Check if your account or EBT mobile application allows you to block or freeze transactions on the account temporarily.

Tips When Using an ATM or POS Terminal, Including for EBT

- Inspecting ATMs, POS terminals, and other card readers before use is crucial in preventing potential fraud. Look for anything loose, crooked, damaged, or scratched. If you notice anything unusual, avoid using the card reader. Check the keypad: Pull at the edges of the keypad before entering your PIN. Cover the keypad as fully as possible when you enter your PIN to prevent cameras from recording your entry. Remember, a pinhole camera may be on or around the terminal.

- Use well-lit, indoor ATMs: These may still be compromised but are less vulnerable targets.

- Being alert in tourist areas is crucial, as skimming devices are commonly found in these locations. Stay vigilant and be cautious when using card readers in such areas. Use debit and credit cards with chip technology: Fewer U.S. devices steal chip data than magnetic stripe data. However, the mag-stripe data on the backs of these cards is still vulnerable.

- Avoid using debit cards with linked accounts: Criminals can access all linked accounts if their debit card is compromised. Use a credit card instead.

- Monitoring your accounts is crucial, as it helps promptly identify any unauthorized transactions. Routinely check your credit card, bank, EBT, or other benefits accounts. Set up email or text alerts to notify you of card or account transactions. Review account security options: These can include multi-factor authentication of transactions or freezing an account between your transactions. While these steps may seem inconvenient, they significantly reduce the risk of financial losses.

- Contact your financial institution immediately: If the ATM doesn’t return your card after you end or cancel a transaction, this may suggest the presence of a foreign device in the card reader.

We at SecureCyberNetwork are dedicated to providing you with the latest updates, tips, and expert advice to keep you safe in the digital world.

Your commitment to staying informed is about your safety, the safety of your loved ones, and the safety of our community.

Your involvement is powerful.