Tax season is stressful enough without the added worry of scams. Unfortunately, IRS-related scams are common in the United States, targeting unsuspecting taxpayers through email, phone calls, and social media. Understanding how these scams work and what steps you can take to protect yourself is crucial. Here’s a comprehensive guide to help you stay vigilant and safeguard your personal information.

The IRS Does Not Initiate Contact via Email, Text, or Social Media

First and foremost, it’s important to remember that the IRS does not initiate contact with taxpayers via email, text messages, or social media to request personal or financial information. This includes requests for:

- PINs

- Passwords

- Access information for credit cards, banks, or other financial accounts

If you receive such a message, it’s a red flag that you are dealing with a scam. For more detailed information on recognizing phishing scams, you can visit the IRS’s phishing information page.

Common IRS Scams and How to Recognize Them

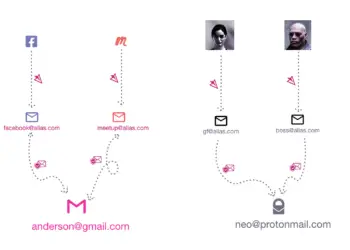

1. Scam Emails Impersonating the IRS

A prevalent scam involves phishing emails that impersonate the IRS, mainly targeting students and staff with “.edu” email addresses. These emails often use subject lines like “Tax Refund Payment” or “Recalculation of your tax refund payment” and contain a fake IRS logo to appear legitimate. They will direct you to click a link and submit personal information to claim a tax refund.

What to Do If You Receive a Scam Email:

- Do not click on any links. If you click on a link and enter confidential information, visit the IRS identity protection page immediately.

- Do not reply to the email.

- Do not open any attachments. Attachments can contain malware that can compromise your computer.

- Forward the email to [email protected] with the full email headers included. Avoid sending screenshots or scanned images, as these remove crucial information.

- Report the scam email to the Federal Trade Commission (FTC). Use the FTC Complaint Assistant on FTC.gov and include “IRS Email Scam” in the notes.

- Delete the original email after taking the above steps.

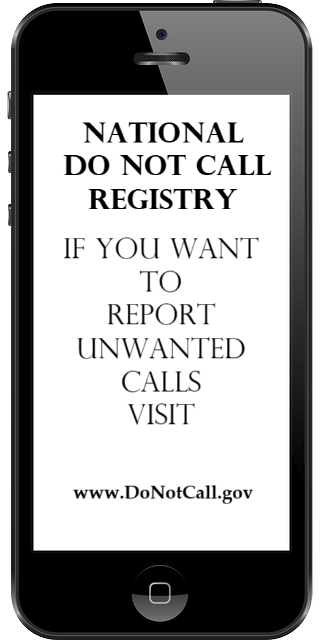

2. Scam Phone Calls Impersonating the IRS

Another common tactic involves phone calls from individuals pretending to be IRS representatives. These callers might claim you owe taxes and demand immediate payment through prepaid debit cards, gift cards, or wire transfers. They may also threaten to involve local police or law enforcement if you don’t comply.

What to Do If You Receive a Scam Phone Call:

- Record the caller’s number and then hang up immediately.

- Report the call to the Treasury Inspector General for Tax Administration (TIGTA).

- Email the number to [email protected] with “IRS Phone Scam” in the subject line.

- Report the call to the FTC using the FTC Complaint Assistant on FTC.gov and add “IRS Phone Scam” in the notes.

Key Points to Remember

- The IRS will not call you to demand immediate payment. They will first send a bill by mail if you owe taxes.

- The IRS will not threaten to bring law enforcement to arrest you for non-payment.

- The IRS will only demand that taxes be paid, allowing you to question or appeal the amount owed.

- The IRS will not call unexpectedly about a tax refund.

By staying informed and cautious, you can protect yourself from falling victim to IRS scams. Always verify the legitimacy of any communication claiming to be from the IRS by contacting them directly through official channels. Remember, if something feels off, it probably is. Stay safe and vigilant during tax season and beyond.

We at SecureCyberNetwork are dedicated to providing you with the latest updates, tips, and expert advice to keep you safe in the digital world.

Your commitment to staying informed is about your safety, the safety of your loved ones, and the safety of our community.

Your involvement is powerful.