With approximately 68 million Americans receiving Social Security benefits, it’s no wonder that scammers frequently exploit the program’s name to deceive people. These fraudsters use various methods, including phone calls, emails, texts, and letters, to impersonate the Social Security Administration (SSA) and obtain personal information. Understanding these scams and how to respond can help protect yourself and your loved ones. Here’s a breakdown of common Social Security scams and the steps to avoid and report them.

The Threatening Phone Call Scam

One of the most prevalent Social Security scams involves fraudulent phone calls. These calls often feature individuals or automated voices claiming to be from the SSA. The caller might demand your Social Security number or request payment, threatening severe consequences if you don’t comply.

Red Flags to Watch For:

- Caller ID Spoofing: Scammers often manipulate caller ID to display the official SSA hotline number (1-800-772-1213), making the call appear legitimate.

- Threatening Language: The caller may claim that you will be arrested or face other legal action unless you provide personal information or call a specific number due to improper or illegal activity involving your Social Security number.

- Immediate Payment Demands: Scammers might request payment via gift cards, prepaid debit cards, or wire transfers.

What to Do:

- Hang Up: If you receive a suspicious call, hang up immediately.

- Do Not Share Information: Never give out personal information, such as your Social Security number or bank details, over the phone.

- Report the Call: Document the phone number and report the call to the Treasury Inspector General for Tax Administration (TIGTA) and the FTC. Email the details to [email protected] with “IRS Phone Scam” in the subject line.

Friendly Service Scams

Another tactic involves scammers posing as SSA representatives and offering to help with free services the SSA provides. They might offer to issue a new Social Security card, enroll a new family member, or provide a record of your contributions.

What to Do:

- Decline the Offer: Politely refuse any unsolicited offers of assistance regarding your Social Security benefits.

- Verify Services: If you need help, contact the SSA through their official website or customer service hotline.

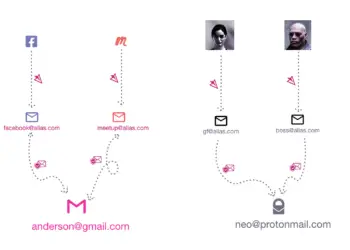

Phishing Emails and Fake Websites

Phishing emails are another standard method scammers use. These emails often appear from the SSA and may include official-looking logos and language. They typically contain links to fake websites designed to steal your personal information.

Red Flags to Watch For:

- Urgent Requests: The email might ask you to click on a link to claim a refund or fix an issue with your benefits.

- Fake Attachments: Attachments may look like official letters from the SSA but are designed to capture your data.

What to Do:

- Do Not Click Links: Avoid clicking on any links or downloading attachments from unexpected emails.

- Do Not Reply: Never reply to such emails with your personal information.

- Report the Email: Forward the email to [email protected] with the full email headers and report it to the FTC.

Mail Scams

While less common than electronic scams, mail fraud still occurs. Scammers send letters that appear to be from the SSA, often targeting older adults. These letters might ask the recipient to call a toll-free number to activate an increase in benefits or other similar ruses.

What to Do:

- Verify the Letter: If you receive a suspicious letter, contact the SSA directly using contact information from their official website.

- Do Not Provide Information: Only provide personal details or call the numbers listed in the letter with verification.

How to Protect Yourself from Social Security Fraud

Be Vigilant:

- Hang Up on Suspicious Calls: If you receive a call asking for your Social Security number or other personal information, hang up immediately.

- Block Scam Numbers: Consider blocking the caller’s number to prevent further nuisance calls, though be aware that scammers can use multiple numbers.

- Secure Your Documents: Store your Social Security card and other sensitive documents safely. Shred documents containing personal information before discarding them.

- Monitor Your Credit: Regularly check your credit reports for any unauthorized activities. Consider using a credit monitoring service.

- Stay Informed: Keep up to date with the latest Social Security scams by visiting the SSA’s Office of the Inspector General (OIG) website.

How to Report a Social Security Scam

If you suspect a scam has targeted you, report it immediately:

- Contact the OIG: Call the Office of the Inspector General hotline at 1-800-269-0271 or submit a fraud report on the OIG’s website.

- Notify the FTC: Report the scam on the FTC’s complaint website.

- Document Details: Provide any information you can, such as the scammer’s phone number, name, and interaction details.

Conclusion

Social Security scams are increasingly sophisticated, but you can protect yourself and your personal information by staying informed and vigilant. Remember, the SSA will never ask for personal information via phone, email, or text. If something feels off, it probably is. Always verify communications and report any suspicious activity to the appropriate authorities. Stay safe and spread the word to help others stay protected, too.

We at SecureCyberNetwork are dedicated to providing you with the latest updates, tips, and expert advice to keep you safe in the digital world.

Your commitment to staying informed is about your safety, the safety of your loved ones, and the safety of our community.

Your involvement is powerful.