Chapter 1: The Unsettling Discovery

Jessica Martinez, a teacher in Houston, Texas, was enjoying her Sunday morning routine—coffee in hand, she walked to her mailbox to collect her mail. She noticed something strange. She hadn’t received any mail for the past few days, which was unusual. Concerned but unsure, she decided to keep an eye on it.

Later that week, while reviewing her bank statement online, Jessica saw several unfamiliar transactions. Panic set in as she realized something was wrong. Her identity had been stolen.

Chapter 2: The Warning Signs

Jessica recalled hearing about identity theft but never imagined it could happen to her. She quickly started to connect the dots:

- Missing Mail: Her mail had been suspiciously absent for the past week.

- Unfamiliar Transactions: Her bank statement showed charges she didn’t recognize.

- Debt Collection Calls: She had received a call from a debt collector about an account she never opened.

These were clear warning signs. Jessica knew she needed to act fast to limit the damage.

Chapter 3: Understanding Identity Theft

Identity theft occurs when someone uses your personal or financial information without your permission. This can include names, addresses, Social Security numbers, credit card numbers, and bank account details.

Jessica learned that identity thieves could steal your information in various ways:

- Stealing Wallets or Purses: Thieves can gain access to ID, credit, and bank cards.

- Dumpster Diving: Retrieving discarded bank statements or tax documents.

- Skimming: Installing devices at ATMs or gas pumps to steal card information.

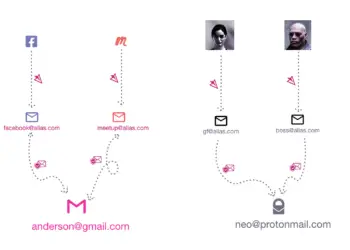

- Phishing: Fraudulent emails, texts, or phone calls to trick you into providing personal information.

- Social Media: Gathering details from your posts or using online quizzes to extract information.

Chapter 4: Reporting the Crime

Jessica needed to report the identity theft to minimize the impact and start the recovery process. Here’s what she did:

- Contacted the FTC: She went to IdentityTheft.gov and reported the theft, getting a personalized recovery plan.

- Notified Credit Reporting Agencies: She contacted Equifax, Experian, and TransUnion to place fraud alerts and a credit freeze on her accounts.

- Informed Financial Institutions: She called her bank and credit card companies to report the fraudulent transactions and have them investigated.

- She filed a police report to obtain a record of the crime. Jessica also filed a report with her local police department.

Chapter 5: Protecting Herself in the Future

Jessica realized she needed to take steps to protect herself from future incidents. She followed these best practices:

- Secure Personal Information: She safely stored essential documents, like her Social Security card, and did not carry them in her wallet.

- Monitor Accounts Regularly: She reviewed her bank and credit card statements for unauthorized transactions.

- Be Cautious Online: Jessica was careful about sharing personal information on social media and avoided quizzes or surveys that asked for such details.

- Use Strong Passwords: She updated her online account passwords, ensuring they were solid and unique.

- Protect Mail: She collected her mail daily and placed a hold on it while away from home.

- Avoid Public Wi-Fi for Sensitive Transactions: Jessica learned to avoid accessing financial information over public Wi-Fi networks.

Chapter 6: Educating Others

After this ordeal, Jessica wanted to help others avoid similar situations. She shared her story at a community meeting, emphasizing the importance of vigilance and prompt action. She provided tips on recognizing identity theft and steps to protect personal information.

Epilogue: A Lesson Learned

Jessica’s experience was a wake-up call, highlighting the importance of protecting personal information. She hoped to prevent others from falling victim to identity theft by sharing her story. Remember, staying informed and cautious can make all the difference in safeguarding your identity.

We at SecureCyberNetwork are dedicated to providing you with the latest updates, tips, and expert advice to keep you safe in the digital world.

Your commitment to staying informed is about your safety, the safety of your loved ones, and the safety of our community.

Your involvement is powerful.