Chapter 1: The Unnerving Call

Maria Rodriguez was a hardworking nurse in Austin, Texas, juggling long shifts and a tight budget. Her phone rang one evening after a particularly grueling day at the hospital. The number was unfamiliar, but she answered, thinking it might be important.

“Hello, Ms. Rodriguez. This is John Davis from XYZ Collections. I’m calling about an outstanding debt of $2,500 from a credit card you opened three years ago,” the stern voice on the other end said.

Maria’s heart sank. She had no recollection of such a debt. “I don’t remember having any debt with that amount,” she replied, trying to stay calm.

The caller’s tone became more aggressive. “If you don’t settle this debt immediately, we’ll have no choice but to take legal action. You could even face jail time.”

Chapter 2: Doubts and Red Flags

Maria felt a wave of panic but also a tinge of skepticism. She asked for more details about the debt and the company. John provided a company name but seemed evasive about specific details. He asked for her social security number and date of birth to “verify” her identity.

Maria’s alarm bells went off. Why would a legitimate debt collector need this information when they supposedly already had it? She remembered reading about debt collection scams and decided to investigate further.

“Can you send me a written validation of this debt?” she asked.

John hesitated, then quickly retorted, “There’s no time for that. You need to pay now to avoid further complications.”

Chapter 3: Seeking the Truth

Feeling uneasy, Maria ended the call and immediately checked her credit report online. There was no mention of the debt that John had claimed. She also noticed that all her existing debts were up to date.

Determined to uncover the truth, Maria called XYZ Collections using the number she found on their official website. The representative there said there was no record of her account or any outstanding debt in her name.

Maria felt relief and anger, realizing she had almost fallen victim to a scam. She reported the incident to her local authorities and filed a complaint with the Federal Trade Commission (FTC).

Chapter 4: Educating Herself and Others

Maria decided to educate herself on the signs of debt collection scams to avoid future incidents. She learned several key points:

- Know Your Debt: Always keep track of your legitimate debts. Obtain your free annual credit report and review it for any inaccuracies.

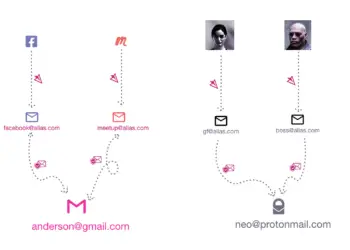

- Verify the Collector’s Information: Real debt collectors should provide their full name, company name, address, phone number, and email. Cross-check this information online.

- No Intimidation Tactics: Deb collectors illegally threaten, lie, or pose as government officials. You won’t go to jail for your debt.

- Payment Methods: Legitimate collectors will accept traceable payment methods. Avoid paying by gift cards, wire transfers, or other untraceable methods.

- Pressure Tactics: Be wary of collectors who insist on immediate payment without providing proper documentation.

Chapter 5: Helping a Friend

A few weeks later, Maria’s friend, Jessica, called her in distress. She had received a similar threatening call about a debt she didn’t recognize. Jessica was ready to pay to avoid “legal action.”

“Wait, Jessica,” Maria interjected. “I went through this. It’s probably a scam. Ask for written validation and their company details. Check your credit report.”

Jessica followed Maria’s advice and discovered it was indeed a scam. She reported the incident and thanked Maria for saving her from a costly mistake.

Chapter 6: Spreading Awareness

Empowered by her experience, Maria began sharing her story with colleagues and community members. She organized a small seminar at the local community center to educate people about debt collection scams. The turnout was better than she expected, and many attendees shared their own experiences and fears.

Maria’s initiative helped several community members avoid falling prey to such scams. She emphasized the importance of staying informed and vigilant and the critical steps to take if they suspect a scam.

Epilogue: Vigilance and Prevention

Maria’s encounter with a debt collection scam had a silver lining. It taught her valuable lessons and ignited a passion for helping others. Her story serves as a reminder that awareness and education are powerful tools against scammers. We can protect ourselves and our communities from falling victim to fraudulent schemes by staying informed and cautious.

We at SecureCyberNetwork are dedicated to providing you with the latest updates, tips, and expert advice to keep you safe in the digital world.

Your commitment to staying informed is about your safety, the safety of your loved ones, and the safety of our community.

Your involvement is powerful.