The Tangled Web: A Story of Real Estate Title Fraud

Chapter 1: The Initial Access

Jenna Thompson loved her quaint vacation home nestled on the outskirts of Aspen. The serene property, with its picturesque views and tranquil surroundings, was her escape from the bustling city life of Denver. However, unbeknownst to her, a sinister plot was brewing.

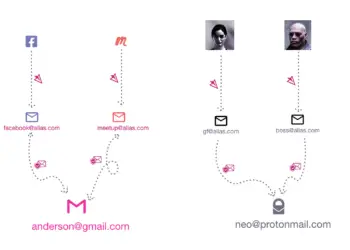

Miles away, in a dimly lit apartment, Victor Alvarez was plotting his next move. An adept con artist, Victor had recently set his sights on vacant properties, and Jenna’s vacation home was the perfect target. With a few clicks, he accessed public records and gathered all the necessary information: the property’s legal description, its address, and Jenna’s personal details.

Chapter 2: The Forgery

Victor was meticulous in his approach. Over the years, he had perfected the art of forgery, and this time was no different. He carefully crafted counterfeit documents, including a deed transferring the property’s title to his alias, Michael Reid. Using stolen identity information, he created a convincing profile to match.

Each document was a masterpiece of deception, indistinguishable from the genuine articles. He even went as far as forging Jenna’s signature, a skill he had honed to perfection.

Chapter 3: Submission of Fraudulent Documents

With the forged documents, Victor went to the local government office responsible for recording property transactions. He confidently submitted the papers, presenting himself as the legitimate owner. Seeing nothing amiss, the clerk processed the documents and recorded the transfer.

Just like that, on paper, Victor—or “Michael Reid”—became the legal owner of Jenna’s beloved vacation home.

Chapter 4: The Title Transfer

The title transfer was seamless. Within days, the records reflected the change in ownership. Victor now had complete control over the property, and Jenna had no idea that her vacation home was no longer hers.

Victor wasted no time exploiting his newfound asset. He listed the property for sale, targeting unsuspecting buyers charmed by the picturesque views and tranquil surroundings. One such buyer, eager to own a piece of Aspen paradise, quickly made an offer.

Chapter 5: Exploitation

Victor sold the property to the unsuspecting buyer, pocketing a substantial sum. The new “owner” had no clue about the fraudulent origins of their purchase. Meanwhile, Victor was already planning his next heist, his appetite for deception insatiable.

Jenna remained blissfully unaware until she decided to visit her vacation home one weekend. To her shock, she found strangers living in her house, claiming they had legally purchased it. Panic set in as she realized she had fallen victim to a sophisticated scam.

Chapter 6: The Red Flags

As the investigation into Jenna’s case unfolded, several red flags became apparent—signs that compliance staff and potential buyers should be aware of:

- Differing signatures: The signatures on the documents submitted by Victor did not match Jenna’s genuine signature.

- The owner/seller lives abroad: Victor claimed to be living overseas, making it difficult to verify in person.

- Recently issued identification documents: The ID documents Victor provided were suspiciously new, raising doubts about their authenticity.

- A lack of knowledge about the property: Victor had limited information about the property’s history and specifics, which should have raised alarms.

- The seller lives at a different address: Victor’s address did not match the property’s address, and he had no supporting documents, such as utility bills or insurance, linking him to the property.

- The property is vacant, of high value, and has no mortgage. Jenna’s vacation home was a prime target because it was vacant and fully paid off.

- The seller wants a quick sale: Victor’s eagerness to close the deal quickly was another warning sign.

Chapter 7: Preventing Title Fraud

To prevent such fraudulent activities, businesses and individuals must adopt stringent measures:

- Identity verification: Use robust know-your-customer (KYC) processes, including identity verification tools and document verification services, to ensure the parties’ authenticity.

- Confirmation of ownership: Cross-reference property ownership records with government databases and property tax records to verify ownership.

- Verification of liens: Check for any outstanding liens or encumbrances on the property that could indicate fraudulent activity or financial distress.

- Employ technology: Utilize technology solutions, such as automated fraud detection algorithms and artificial intelligence (AI), to detect anomalies in property transactions.

- Ongoing monitoring: Implement continuous monitoring of property titles for any suspicious changes or transfers.

- Risk-based approach (RBA): According to sector-specific guidance by the Financial Action Task Force (FATF), using an RBA as the foundation for anti-money laundering (AML) and combatting the financing of terrorism (CTF) program helps firms prevent and manage risks effectively.

Epilogue: A Lesson in Vigilance

Jenna’s story is a strong reminder of the risks associated with real estate title fraud. It emphasizes the importance of remaining vigilant, having strong legal protections, and staying well-informed. Although she eventually regained property ownership, the experience left a lasting impact.

Victor’s deceitful actions highlight the constant threat posed by fraudsters within the real estate industry. However, through awareness and precaution, homeowners can shield themselves from falling victim to the complicated web of real estate title fraud.

We at SecureCyberNetwork are dedicated to providing you with the latest updates, tips, and expert advice to keep you safe in the digital world.

Your commitment to staying informed is about your safety, the safety of your loved ones, and the safety of our community.

Your involvement is powerful.