A Life Savings Gamble on Bitcoin

John had always been curious about Bitcoin, hearing endless stories about how it had turned ordinary people into millionaires. However, he never took the plunge—until now. When Bitcoin hit an all-time high of $96,000, John decided it was finally time to invest.

He was approached by a so-called “crypto expert,” who promised him that this was a golden opportunity. “Bitcoin is going to skyrocket to $150,000 soon,” they said confidently. “If you don’t invest now, you’ll regret it.”

Caught up in the excitement, John made a life-changing decision: he invested his entire savings of $23,000 into Bitcoin at its peak price of $96,000. He imagined himself riding the wave of profits and finally achieving financial freedom.

But the reality turned out to be very different. Shortly after John’s investment, Bitcoin’s price began to plummet. The predictions of $150,000 were nothing but empty promises, and John’s $23,000 savings quickly shrank in value. He learned the hard way that investing at the peak of a market, driven by hype and pressure, often leads to devastating losses.

The Risks of Buying Bitcoin at Its Peak

John’s mistake is one that many new investors make, especially in the volatile world of cryptocurrency. Here’s where he went wrong:

Investing Everything at an All-Time High

The golden rule of investing is to buy low and sell high, but John did the opposite. By investing when Bitcoin was at its highest price of $96,000, he set himself up for potential losses when the market corrected.Trusting False Promises

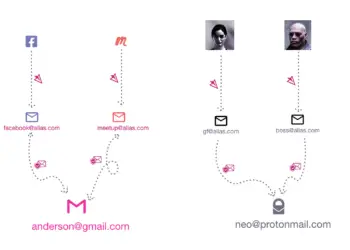

The claim that Bitcoin would “easily reach $150,000” was pure speculation. No one can predict the market with certainty, and anyone making such promises is likely preying on your emotions.Ignoring Market Research

John relied on the hype and the words of an unverified “expert” instead of researching Bitcoin’s historical trends, risks, and market behavior. This lack of preparation left him vulnerable to poor decision-making.Investing His Entire Savings

Cryptocurrencies like Bitcoin are highly volatile, and investing more than you can afford to lose is a recipe for disaster. Diversification and risk management are critical when investing.

Bitcoin at an All-Time High

At $96,000, Bitcoin had reached its all-time high. While it’s tempting to jump on the bandwagon during such moments, it’s important to remember that high prices often signal increased risk of a market correction.

The truth is, cryptocurrency markets are unpredictable. Just because Bitcoin is at a record price doesn’t mean it will keep rising. As John’s story shows, buying at the peak can lead to significant losses, especially if the price falls before you have the chance to sell.

Lessons for All Bitcoin Investors

If you’re considering investing in Bitcoin, here are some key takeaways to help you avoid the mistakes John made:

Buy Low, Sell High

The best investment opportunities come when prices are low, not when they’re at record highs. Be patient and wait for the right moment.Do Your Research

Learn about Bitcoin and the factors influencing its price. Avoid making decisions based on hype or the advice of unverified individuals.Use Trusted Exchanges

Only invest through reputable cryptocurrency platforms with a track record of security and transparency. Avoid third-party brokers or schemes that sound too good to be true.Diversify Your Investments

Never put all your money into one asset. Spread your investments across different opportunities to minimize risk.Invest Only What You Can Afford to Lose

Cryptocurrencies are highly volatile. Always invest an amount you’re comfortable losing without it jeopardizing your financial security.

Bitcoin Requires Caution

John’s $23,000 loss is a sobering reminder of the risks associated with investing in Bitcoin during market highs. While cryptocurrency can offer incredible opportunities, it also comes with significant volatility and uncertainty.

If you’re thinking about buying Bitcoin, take the time to educate yourself, avoid FOMO, and invest wisely. And remember, no investment is guaranteed—promises of easy money are often a red flag.

Let’s learn from John’s experience and make smarter, more informed decisions when it comes to Bitcoin and other investments.

#BitcoinInvesting #CryptoSafety #BitcoinHighs #InvestSmart

We at SecureCyberNetwork are dedicated to providing you with the latest updates, tips, and expert advice to keep you safe in the digital world.

Your commitment to staying informed is about your safety, the safety of your loved ones, and the safety of our community.

Your involvement is powerful.