A massive data breach has been confirmed by National Public Data, a company that aggregates information for background checks. The breach, which involved Social Security numbers, names, addresses, email addresses, and phone numbers, affected 2.9 billion records. A tool developed by the cybersecurity firm Pentester.com can help users determine if their data was compromised.

National Public Data, based in Coral Springs, Florida, posted a notice indicating that the breach occurred due to a third-party bad actor attempting to access data in December 2023, with further potential leaks identified in April 2024 and summer 2024.

The breach was initially brought to light through a class-action lawsuit filed in U.S. District Court in Fort Lauderdale, Florida, and reported by Bloomberg Law. According to the lawsuit, 2.9 billion records, including personal data dating back at least three decades, were stolen. National Public Data has stated that they are cooperating with investigators and have implemented additional security measures to prevent future breaches.

The breach poses a significant risk, particularly since Social Security numbers are commonly used in financial applications. Pentester.com cofounder Richard Glaser has advised consumers to freeze their credit reports as a precaution. Glaser noted that while names, addresses, and phone numbers can change, Social Security numbers do not, making them especially valuable to threat actors.

Odysseas Papadimitriou, CEO of WalletHub, also recommended freezing credit reports, stating that it is more effective than simply placing a fraud alert. The lawsuit alleges that the cybercriminal group USDoD was responsible for the breach, posting the stolen data on the dark web in April 2024, where it was offered for sale for $3.5 million.

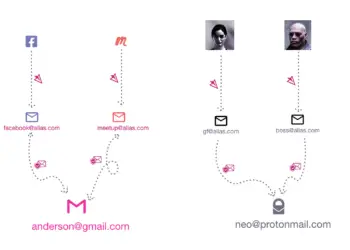

For more detailed information and to check if your data was compromised, visit the Pentester tool at:

If you are affected, follow the guidance below!

What is a Credit Freeze?

A credit freeze, also known as a security freeze, restricts access to your credit report. This makes it more difficult for identity thieves to open accounts in your name because most creditors need to see your credit report before approving a new account. A credit freeze does not affect your credit score and can be lifted temporarily or permanently by using a PIN or password.

Steps to Freeze Your Credit

To freeze your credit, you need to contact each of the three major credit bureaus. You can do this online, by phone, or by mail:

Equifax

- Online: Visit the Equifax website.

- Phone: Call 1-800-349-9960.

- Mail: Send your request to Equifax, P.O. Box 105788, Atlanta, GA 30348-5788.

Experian

- Online: Visit the Experian website.

- Phone: Call 1-888-397-3742.

- Mail: Send your request to Experian, P.O. Box 9554, Allen, TX 75013.

TransUnion

- Online: Visit the TransUnion website.

- Phone: Call 1-888-909-8872.

- Mail: Send your request to TransUnion, P.O. Box 160, Woodlyn, PA 19094.

Information You Need to Provide

When requesting a credit freeze, you’ll typically need to provide the following information:

- Full name, including middle initial and suffix (e.g., Jr., Sr., III)

- Social Security number

- Date of birth

- Address (and previous addresses if you’ve moved in the past two years)

- Copies of your government-issued ID (e.g., driver’s license)

- Copies of a utility bill, bank statement, or insurance statement to verify your current address

How Long Does It Take?

- The credit bureaus must place the freeze within one business day if you request it by phone or online.

- If requested by mail, they must place the freeze within three business days of receiving your request.

- You’ll receive confirmation from each bureau, along with a PIN or password that you can use to lift the freeze when needed.

Freezing vs. Fraud Alert

A credit freeze is more comprehensive than a fraud alert. While a fraud alert notifies creditors to take extra steps to verify your identity before opening new accounts, it does not prevent access to your credit report entirely. A credit freeze, on the other hand, blocks access to your credit report until you lift the freeze with your PIN.

Important Considerations

- Cost: Credit freezes are free under federal law.

- Temporary Lift: If you need to apply for credit or loans, you can temporarily lift the freeze for a specific time or for a particular creditor.

By freezing your credit, you can significantly reduce the risk of unauthorized accounts being opened in your name, providing an essential layer of protection in the wake of a data breach.

We at SecureCyberNetwork are dedicated to providing you with the latest updates, tips, and expert advice to keep you safe in the digital world.

Your commitment to staying informed is about your safety, the safety of your loved ones, and the safety of our community.

Your involvement is powerful.