As digital technology continues to advance, so do scammers’ tactics, making it more critical than ever for everyone, regardless of age, to be vigilant. In 2023, the reported scam cases across various age groups revealed some troubling trends that highlight the widespread impact of online fraud and scams.

Scam Cases by Age Group

Under 20:

In 2023, young individuals under 20 reported 18,174 scam cases, leading to a total financial loss of $40,703,428. While this age group might seem tech-savvy, they are not immune to the sophisticated methods employed by modern-day scammers.

Aged 20 to 29:

This group reported 62,410 scam cases, with a staggering total loss of $360,743,568. Young adults, often entering the workforce and managing finances independently for the first time, are frequent targets for scams like employment fraud and phishing schemes.

Aged 30 to 39:

With 88,138 reported cases, this group experienced losses totaling $1,167,165,071. This age group often has significant financial responsibilities, such as mortgages and family expenses, making them prime targets for investment scams and other high-value frauds.

Aged 40 to 49:

This age group reported 84,052 cases, resulting in total losses of $1,501,216,581. With established careers and savings, individuals in their 40s are often targeted by scammers posing as financial advisors or offering fraudulent investment opportunities.

Aged 50 to 59:

65,924 reported cases led to a total loss of $1,681,873,944. As people in this age group approach retirement, they may be more susceptible to pensions, retirement funds, and healthcare scams.

Over 60:

The most concerning statistics come from those over 60, who reported 101,068 scam cases with a massive total loss of $3,427,717,654. This group is particularly vulnerable, and the impact of these scams can be devastating, often wiping out life savings and jeopardizing their financial security in retirement.

Why the Elderly Are More Likely Victims

The elderly population, particularly those over 60, is disproportionately affected by scams for several reasons:

- Isolation: Older adults, especially those who live alone, maybe more isolated and thus more likely to engage with unknown callers or respond to unsolicited emails. Scammers exploit this loneliness by posing as friendly, trustworthy individuals.

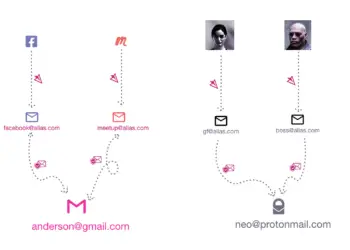

- Lack of Familiarity with Technology: While many older adults are becoming more tech-savvy, a significant portion may need to be more familiar with digital platforms and cybersecurity practices. This lack of knowledge makes them easier targets for online scams, such as phishing, where they might inadvertently provide personal information to fraudsters.

- Financial Stability: Scammers often target older adults because they tend to have more substantial savings, pensions, and retirement accounts. This economic stability makes them attractive targets for fraud schemes promising high returns or requiring large upfront payments.

- Cognitive Decline: Age-related cognitive decline can impair judgment and make it harder for older adults to recognize scams. Scammers take advantage of this by creating complex and convincing stories that can confuse even those who are generally cautious.

- Trusting Nature: Many older adults grew up in a time when trust was more common in personal and business relationships. Scammers exploit this trusting nature, knowing that older individuals might be less skeptical of a “too good to be true” offer.

Protecting the Elderly from Scams

To protect older adults from these pervasive threats, it is crucial to:

- Raise Awareness: Educate older adults about common scams and how to recognize them. This includes explaining the importance of not sharing personal information over the phone or through email.

- Promote Cybersecurity: Encourage using strong, unique passwords, two-factor authentication, and other cybersecurity measures to protect online accounts.

- Monitor Financial Accounts: Regularly monitor bank and credit accounts for suspicious activity. Setting up alerts can help catch unauthorized transactions early.

- Encourage Open Communication: Older adults should feel comfortable discussing financial matters with trusted family members or advisors, especially if they encounter something suspicious.

- Report Scams: Encourage the reporting of scams to authorities, which can help prevent others from becoming victims.

The data presented in this post is sourced from the Federal Bureau of Investigation’s (FBI) Elder Fraud Report from 2023. It reflects all reported cases of scams and fraud across various age groups. However, it’s important to note that these figures only account for reported incidents and do not include unreported cases. The actual number of scams and the total financial loss are likely much higher, as many victims feel ashamed or embarrassed about falling for these scams and choose not to report them.

The statistics from 2023 serve as a stark reminder that scams are a serious issue affecting all age groups, particularly older adults. Understanding these risks and taking proactive steps can help protect ourselves and our loved ones from falling victim to these harmful schemes.

Visit Secure Cyber Network for more information on how to stay safe online.

We at SecureCyberNetwork are dedicated to providing you with the latest updates, tips, and expert advice to keep you safe in the digital world.

Your commitment to staying informed is about your safety, the safety of your loved ones, and the safety of our community.

Your involvement is powerful.